How/where are firms recording the ITAX Prepay, Fiduciary Returns and Status Report due dates in the matter details?

Solved

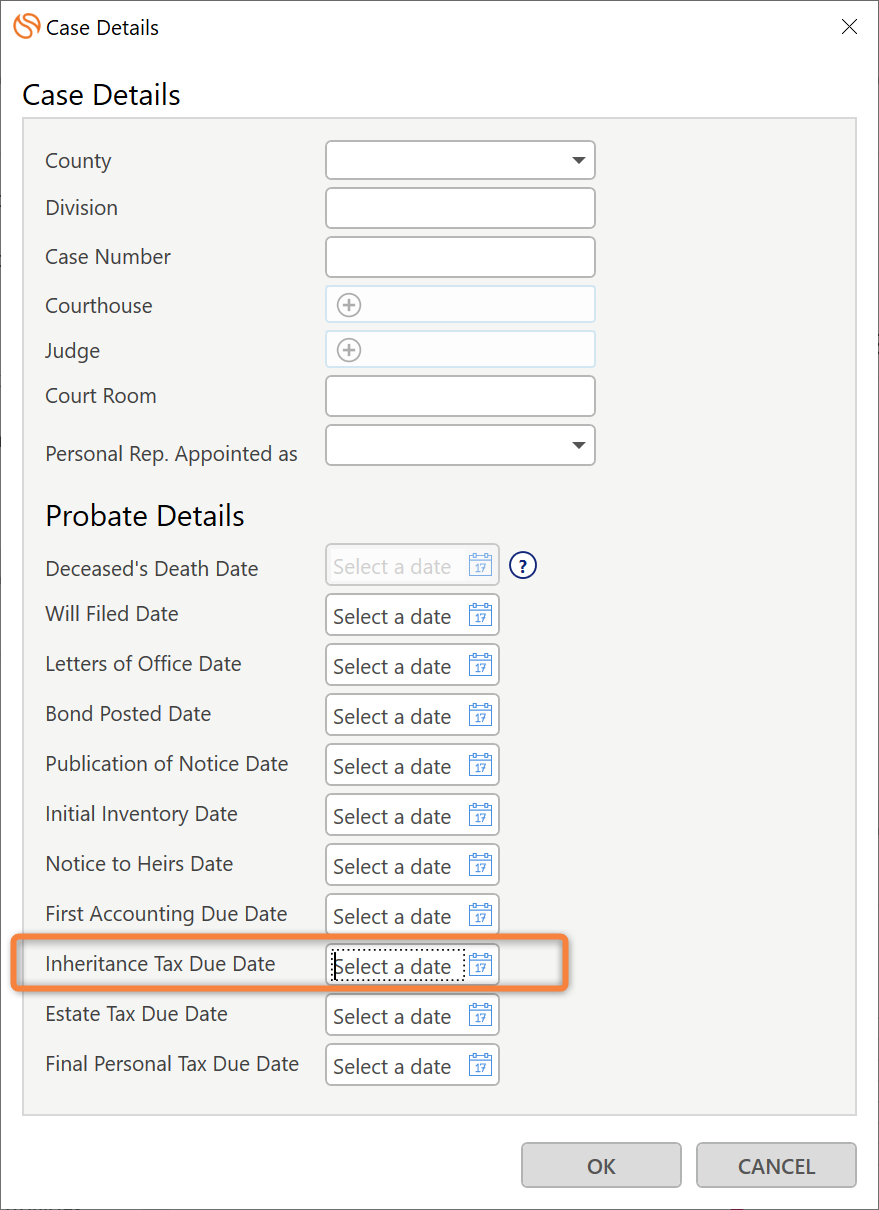

Recording Due Dates Related to Inheritance Tax (Pennsylvania)

Best answer by Sara Sultan

Hello

What matter type are you using? In our Decedent’s Estate matter type on the Case Details layout, there is a spot to track the Inheritance Tax Due Date. We may be able to add the other due dates as well if they are standard in Pennsylvania matters. You can then use workflows to send you task reminders of the deadlines.

Sign up for best practice advice, tips and to connect with your peers.

Already have an account? Login

Login or create an account

No account yet? Register

Login with your Smokeball account

Login with Smokeballor

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.