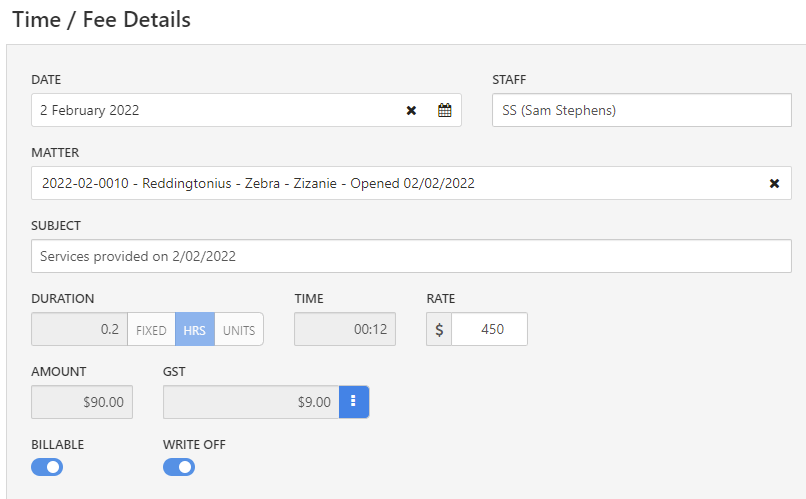

I include a lot of admin activity and smaller communications in my invoices which currently requires me to mark them as “billable” and manually go in and waive the charge. It shows clients value and keeps them informed of actual activity even though we aren’t charging them for it.

Unless I’m not doing something right, this appears to be showing as billed and uncollected in the fee insights/reporting. That is giving me very misleading information that I can’t truly dig into since I can’t customize the reporting to not consider waived time.

The only way around this that I can come up with for reporting purposes is to bill for everything and then give an invoice credit. However, that will cause significant problems with client understanding and perception of value (creating the opposite of my intention of showing lots of “no charges”)…

Is there a way to adjust what is included or how the waived time is classified so that my actual collection rate on charges shows up?