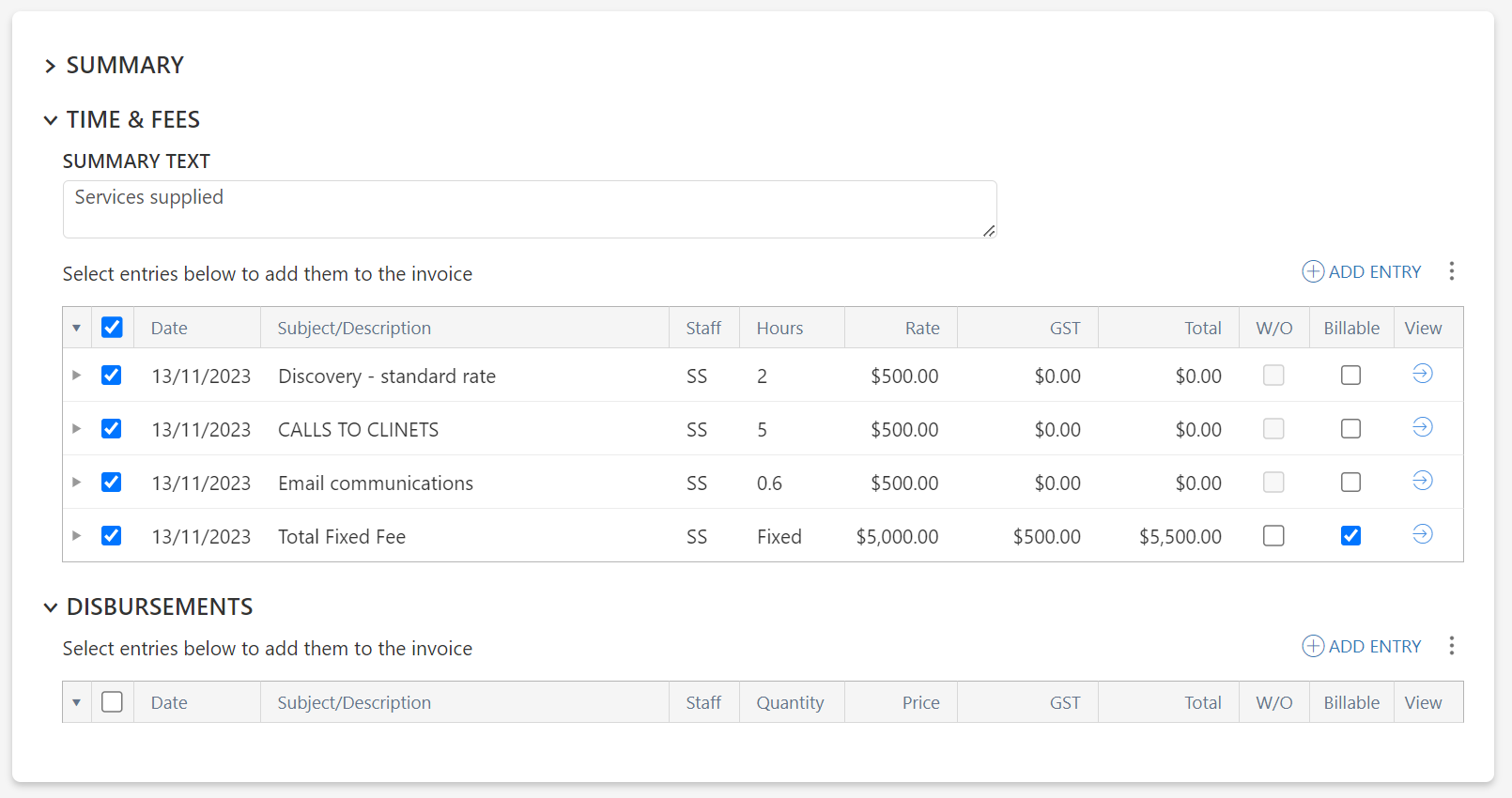

We have a couple of matters where we bill pursuant to contracts as a fixed fee - however we always enter our time worked on the matter so we can track where we are sitting against the fee proposal. We never include the individual time entries on the invoice though.

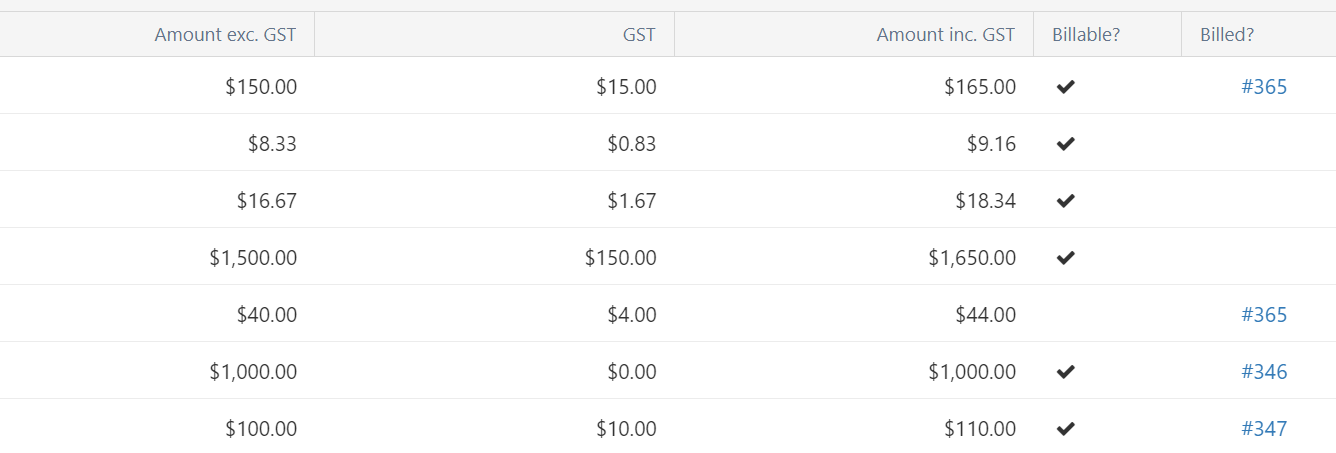

The usual process for billing on our old system was to invoice as a fixed fee, then mark the corresponding time entries as “non-billable” so that we could identify how much WIP had not yet been ‘billed’ and how we were tracking against certain stages of the project.

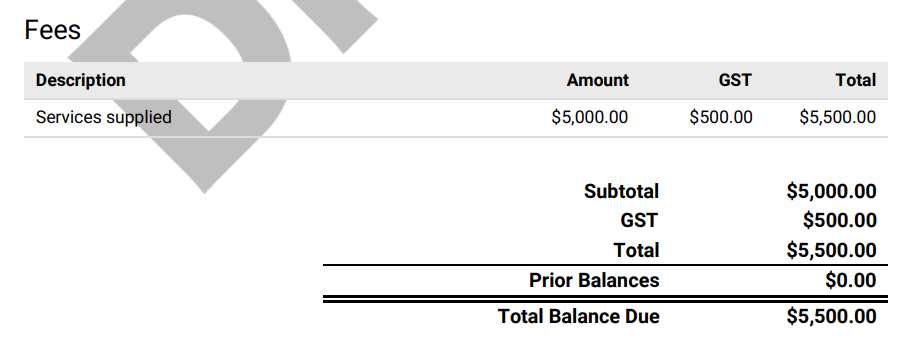

I’m wondering if there is a way we can allocate time entries to an invoice - but not show the individual line items and bill as a fixed fee with a one line summary? This would help for EOM WIP reports etc.