How/where are firms recording the ITAX Prepay, Fiduciary Returns and Status Report due dates in the matter details?

Best answer by Sara Sultan

View originalHow/where are firms recording the ITAX Prepay, Fiduciary Returns and Status Report due dates in the matter details?

Best answer by Sara Sultan

View originalHello

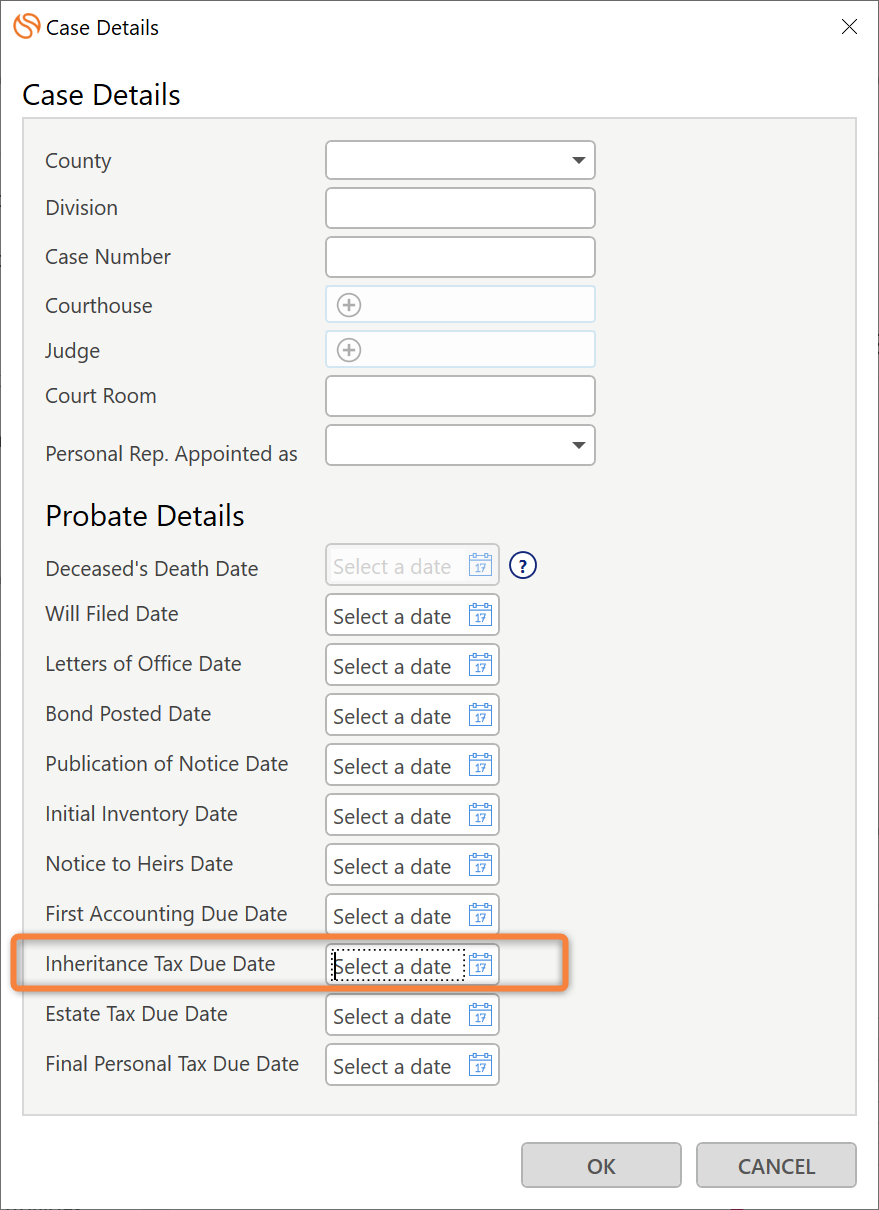

What matter type are you using? In our Decedent’s Estate matter type on the Case Details layout, there is a spot to track the Inheritance Tax Due Date. We may be able to add the other due dates as well if they are standard in Pennsylvania matters. You can then use workflows to send you task reminders of the deadlines.

Thank you for the reply, Sara! There is an ITAX Prepay due date that is separate from the ITAX due date. It would be beneficial to have fields for each. ITAX Prepay, Fiduciary Returns and Status Report due dates are standard in Pennsylvania matters.

Already have an account? Login

No account yet? Create an account

Enter your username or e-mail address. We'll send you an e-mail with instructions to reset or create your password.