Welcome to the February legal content update! This month’s edition includes a look at the exciting new ACT Settlement Statement, new Tax Litigation Matter Type, as well as improvements to Smokeball reports.

Let’s take a look at the main highlights.

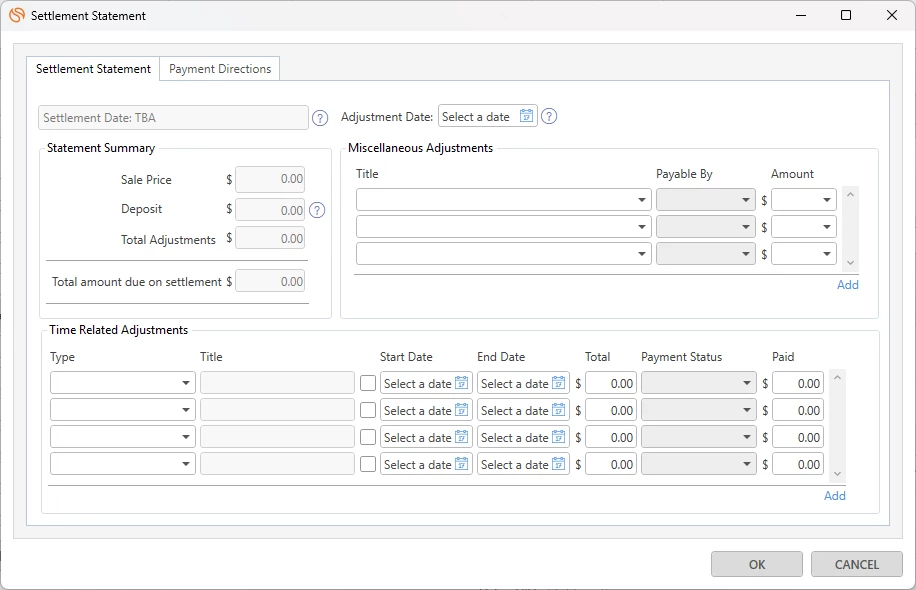

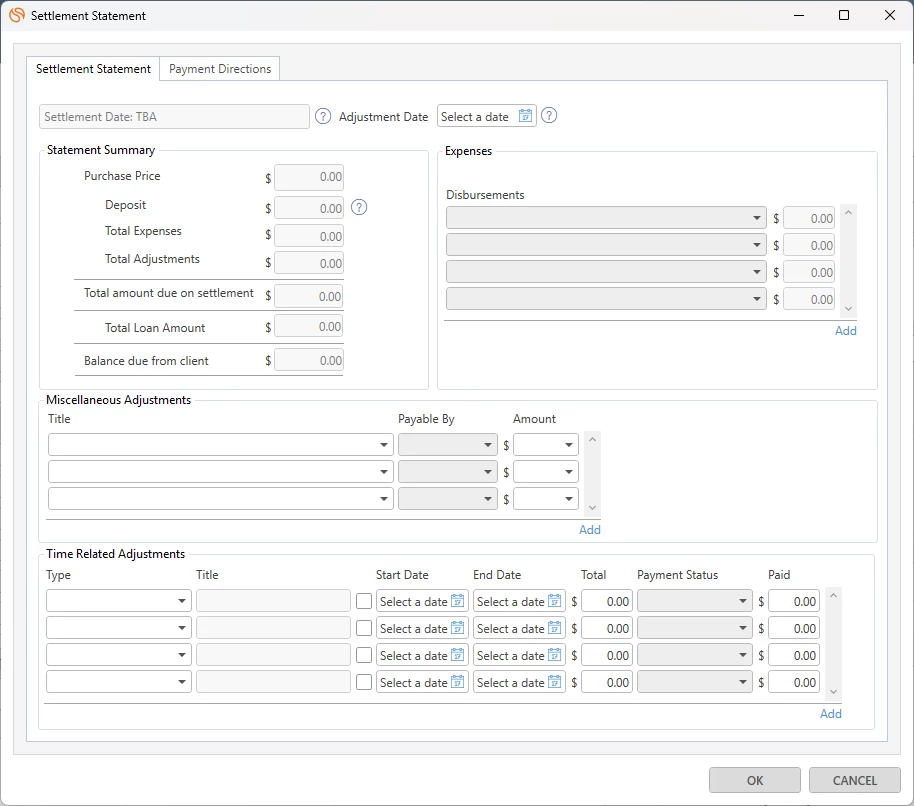

ACT Settlement Financials

The Legal Product team are excited to announce the release of the new ACT Settlement Statement in Conveyancing Sale and Purchase matters. Click here for the full support hub article on how Settlement Statement layouts work on these matters together with their corresponding precedents available in the Precedent Library.

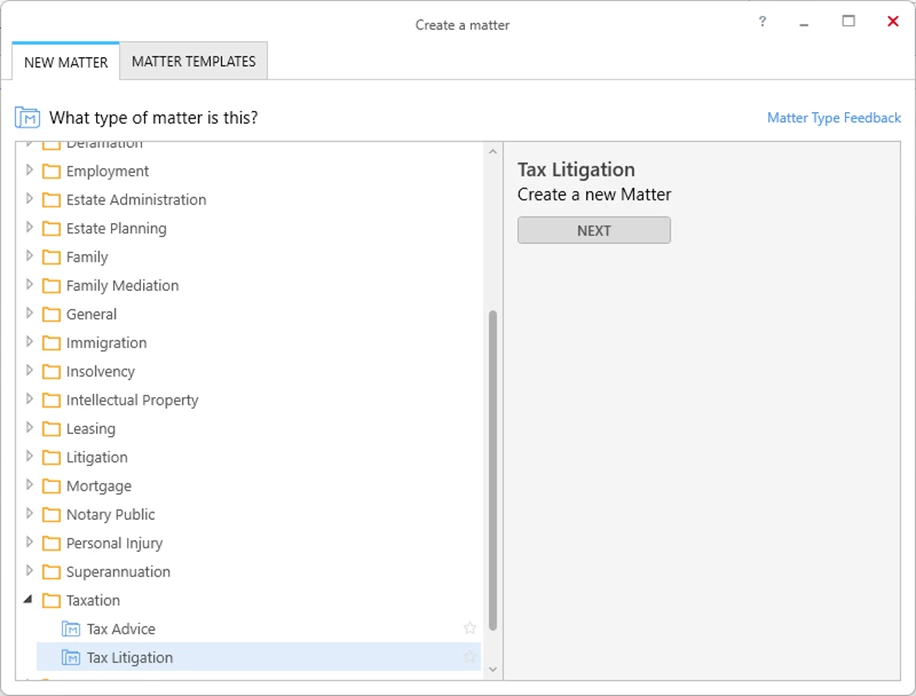

Tax Litigation Matter Type

This month we also released a new matter for Tax Litigation which can be used for both Federal and State tax audits and disputes. Check out the Support article here.

Form Updates

This month we also made a number of updates to the following form suites in the Precedent Library:

- VIC VOCAT forms

- Fair Work Commission forms

- Supreme Court of VIC forms

- SA Forms > CTP Insurance Regulator forms

- Marketplace Precedents:

- Lexon Insurance: Updates to EMR Pack.

- FLENA: Updates to some precedent letters.

Report Updates

We have also made an enhancement to the Matter - Full List Smokeball desktop report by updating the existing Person Assisting field. It is now shown as two separate fields:

- Primary Person Assisting

- Other Person Assisting

In addition, filters for Primary Person Assisting and Other Person Assisting have been added, allowing users to more easily refine and review matters based on the assisting person.

That’s all for now, but look out for the next update in March!

As always please post your questions and requests by hitting “Reply” below.